Minato Management Co., Ltd. hereby announces the completion of mediation of trust beneficiary rights as a Type II Financial Instruments Business Operator, as outlined below.

Our company, primarily engaged in real estate brokerage, actively extends mediation services for real estate trust beneficiary rights in addition to tangible real estate as part of our investment-related activities.

1. Property Overview Location:

Kobe City, Hyogo Prefecture

2. Transaction Overview:

In accordance with confidentiality obligations with the acquisition party, details regarding the parties involved in the transaction and transaction specifics will not be disclosed. Furthermore, there are no capital relationships, personnel relationships, or transactional relationships to be disclosed between our company and the parties involved in the transaction, and there are no concerns regarding attributes.

PHILOSOPHY

It is our sincerest desire to meet the needs of our clients. Whenever we see people devoting themselves to their business and seeking a better society and future, this wish of ours becomes ever stronger.

We spare no effort in working for each client in front of us not only as professionals evaluating business value, but also as human beings.

So it is our mission to make sincere investments, seriously and honestly, in a sound investment environment.

Is there integrity in your investment? We are a Japanese company that never stops asking the question as both professionals and human beings.

NEWS

-

Announcement of Trust Beneficiary Rights Mediation

-

Notification of Real Estate Sale

We would like to inform you that Minato Management Co., Ltd. (Headquarters: Toranomon 1-1-12, Minato-ku, Tokyo, Representative Director: Tatsuto “Tad” Kuramoto) has sold the following real estate for sale:

Our company is actively engaged in real estate management, and we believe that this sale has significantly contributed to our accumulated experience in real estate transactions.

We will continue to actively pursue investments in real estate and the formation of real estate investment funds in the future.

1. Property Overview

Location: Fukuoka City, Fukuoka Prefecture

Property Type: Condominium2. Buyer and Transaction Overview

Due to confidentiality obligations with the buyer, we refrain from disclosing details such as the buyer’s information and transaction specifics. Furthermore, there are no disclosed capital relationships, personnel relationships, or transactional relationships between our company and the buyer, and we have determined that there are no issues regarding attributes. -

We’ve Revamped Our Company’s English Website!

We are pleased to announce the renewal of our website. Below are the main points of the renewal:

1. Establishment of a New Tagline:Since our establishment in 2005, we have been able to grow steadily thanks to the generous support we have received from everyone.

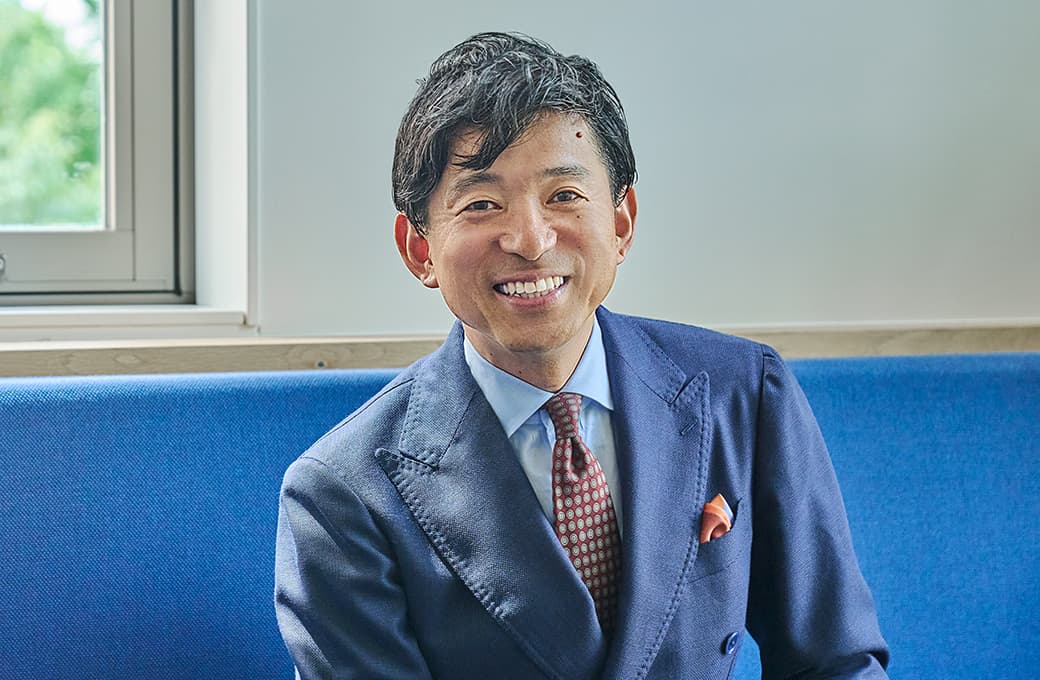

Year 2023 marks the 10th anniversary of our representative, Mr. Kuramoto, becoming our representative director.

In renewing our website this time, we have reexamined our current company’s character, the vision we should aim for in the future, and the path we should take. As a result, we have decided to set the following as our new tagline:“To protect investment integrity”

2. Addition of Corporate Philosophy:

Based on our new tagline, “To protect investment integrity”, we have established our mission as:“Creating the FAIR investment environment.”

And we have defined our vision as:

“Providing a sense of Japanese hospitality to financial assets.”

In order to achieve this mission, we have added “Beyond The Manual” as one of our new corporate philosophies, in addition to the following values we have upheld so far:

– Innovative Spirit

– Professional Sense

– Global Perspective3. Revision of Business Description Page Structure:

We have revised the description of our business overview, which was previously categorized as “Fund Business” and “Real Estate Business,” to “Fund Management/Investment Business” and “Investment-related Business,” respectively, to better reflect our current business reality, and updated the content accordingly.Under our new tagline and corporate philosophy, we will continue to pursue business that is unique to Minato Management without losing sight of its core spirit.

*All individuals depicted on each page are members of our company. Some have demonstrated unexpected acting skills in response to requests from the production company, and we all participated in the production of the website while enjoying ourselves. We believe that this demonstrates our corporate culture of “working together with everyone to push things forward.”

ABOUT US

MESSAGEMessage from CEO

We are a group of professionals working sincerely to protect the integrity of your investment.

Here is what CEO Kuramoto has to say about Minato Management’s investment philosophy, as well as our values and beliefs.

READ MORE

PROFESSIONALSOur Members

All members share the same code of values, with each doing their utmost on every project. We focus wholeheartedly on benefiting clients.

Please meet our main members, who are specialists from different fields. Let’s also hear what they have to say about the value only Minato Management can offer and future prospects.

READ MORE

COMPANY OUTLINECompany Outline

READ MORE

BUSINESS

FUND MANAGEMENT

/ INVESTMENT

Minato Management contributes to society by creating capital flows through its unique fund compositions and proprietary investments based on accurate evaluation of investment value.

READ MORE

INVESTMENT

RELATED BUSINESS

We make the most of our expertise and experience to provide services that now in high demand, thereby helping investors and stimulating fresh economic activity.

READ MORE