Minato Management Co., Ltd. (Head Office: 1-1-12 Toranomon, Minato-ku, Tokyo; Representative Director: Tatsuto Kuramoto) has launched a ship operating lease fund targeting a Panamax-size bulk carrier.

This project involves a European shipping company as the lessee and marks the company’s first ship-related fund of the year.

In 2025, Minato Management successfully structured three operating lease funds, handling over 2 billion yen (JPY equivalent) in total equity. With a goal of forming four ship-related funds in 2026, we will continue striving to offer sound investment opportunities and steady operations.

PHILOSOPHY

It is our sincerest desire to meet the needs of our clients. Whenever we see people devoting themselves to their business and seeking a better society and future, this wish of ours becomes ever stronger.

We spare no effort in working for each client in front of us not only as professionals evaluating business value, but also as human beings.

So it is our mission to make sincere investments, seriously and honestly, in a sound investment environment.

Is there integrity in your investment? We are a Japanese company that never stops asking the question as both professionals and human beings.

NEWS

-

Announcement of Launch of Ship Operating Lease Fund

-

Notice Regarding Sale of Real Estate for Sale

Minato Management Co., Ltd. (Head Office: 1-1-12 Toranomon, Minato-ku, Tokyo; Representative Director: Tatsuto “Tad” Kuramoto) hereby announces the sale of a real estate property held for sale, as detailed below.

Going forward, we will continue to actively expand our real estate business through both fund-based direct property investments and proprietary investments.

1. Property Overview

Location: Yokohama City, Kanagawa

Property Details: Commercial unit within a building2. Buyer and Transaction Overview

Due to confidentiality obligations with the buyer, we refrain from disclosing specific details of the buyer and transaction.

There are no capital, personnel, or business relationships to be noted between our company and the buyer, and there are no issues regarding the attributes of the counterparty. -

Announcement of the Second Real Estate Specified Joint Enterprise Act (FIEA) Fund Targeting Group Homes for Persons with Disabilities

Minato Management Co., Ltd. (Head Office: 1-1-12 Toranomon, Minato-ku, Tokyo; Representative Director: Tatsuto Kuramoto) is pleased to announce the establishment of a fund under the Real Estate Specified Joint Enterprise Act (hereinafter, “FIEA”) in collaboration with Japan Asia Investment Co., Ltd. (https://www.jaic-vc.co.jp, hereinafter, “JAIC”). The fund invests in 13 group homes for persons with disabilities.

This marks the second fund under the FIEA framework, following the first one organized in January 2024. Continuing from the previous initiative, this project aims to contribute to the creation of a sustainable social infrastructure through both welfare and finance, supporting the independence of persons with disabilities and promoting inclusive communities.

■ Significance of Investment in Group Homes for Persons with Disabilities

“Group homes for persons with disabilities,” officially referred to as “Community Living Assistance,” are one of the welfare services established under the Act on the Comprehensive Support for the Daily and Social Life of Persons with Disabilities.

Operators of such homes reside on-site to support daily life activities—such as meal preparation, bathing assistance, and personal care—helping residents live independently within their communities.These facilities play an important role in preventing social isolation and fostering community participation, yet supply remains insufficient relative to the growing social demand.

Minato Management positions investment in this sector as a stable and socially meaningful asset management business that addresses critical societal needs.■ Future Outlook

Minato Management will continue to collaborate with JAIC and other partners to invest in real estate assets that generate positive social impact.

As financial professionals, we remain committed to delivering value to our investors while pursuing both social contribution and sustainable economic returns.

ABOUT US

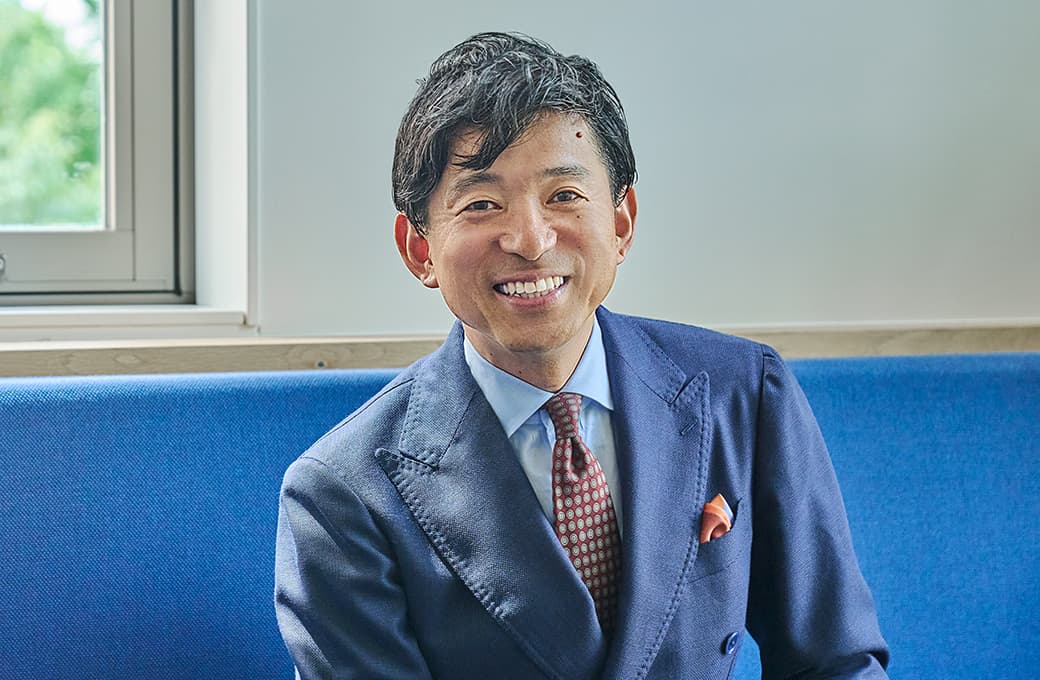

MESSAGEMessage from CEO

We are a group of professionals working sincerely to protect the integrity of your investment.

Here is what CEO Kuramoto has to say about Minato Management’s investment philosophy, as well as our values and beliefs.

READ MORE

PROFESSIONALSOur Members

All members share the same code of values, with each doing their utmost on every project. We focus wholeheartedly on benefiting clients.

Please meet our main members, who are specialists from different fields. Let’s also hear what they have to say about the value only Minato Management can offer and future prospects.

READ MORE

COMPANY OUTLINECompany Outline

READ MORE

DATAMinato in numbers

As an introduction to Minato Management, we have visualized the composition of sales for each business through figures and graphs.

DATA.01

SALES COMPOSITION RATIO

(Sales average for 2021, 2022 and 2023)

DATA.02

COMPOSITION RATIO OF

PROPERTIES BEING MANAGED AS SOLAR AM

(FY2023)

DATA.03

AVERAGE TRANSACTION AMOUNT FOR

REAL ESTATE TRUST

BENEFICIARY RIGHTS BROKERAGE

beneficiary rights brokerage

(2022、2023)

DATA.04

REAL ESTATE

TRANSACTION COMPOSITION RATIO

Based on number of cases handled

(as of 2024)

DATA.05

TYPES OF INVESTORS OF THE FUNDS

Attribute names are based on the definitions of

the Financial Instruments and Exchange Act

(as of 2024)

BUSINESS

FUND MANAGEMENT

/ INVESTMENT

Minato Management contributes to society by creating capital flows through its unique fund compositions and proprietary investments based on accurate evaluation of investment value.

READ MORE

INVESTMENT

RELATED BUSINESS

We make the most of our expertise and experience to provide services that now in high demand, thereby helping investors and stimulating fresh economic activity.

READ MORE