Isesaki Tabei Solar Park

Location: Gunma Pref.

Module Output: 1,876.8kW

Completion year: July 2018

FUND MANAGEMENT /

INVESTMENT

At Minato Management, we believe all assets and enterprises have value and a social significance. However, there are also certain assets that even while exhibiting such value, do not readily become investment targets for a variety of reasons, including the environment, liquidity and scale. In addition, a class of assets exists that even while maintaining social significance as the framework that supports regional and national infrastructure, are under-valued as investment targets. Here at Minato Management, we engage in fund raising while shining a light on such assets, and are committed to creating viable investment schemes. We do not merely provide conventional, ready-made transactions. Because the distance between investment assets and businesses and the investor is so close, Minato Management is able to deliver a client-oriented tailor made fund flow infrastructure within the framework of fund management.

The expansion of sustainable energy-based power supply has become a global trend, and the sustainable energy market has rapidly grown in Japan following the 2012 introduction of the Feed-in Tariff(FIT)system. Minato Management is engaged in the development and operation of mega-solar facilities, with a generating capacity in excess of 1 MW, and in managing such operations.

Location: Gunma Pref.

Module Output: 1,876.8kW

Completion year: July 2018

Location: Fukushima Pref.

Module Output: 1,528.2kW

Completion year: April 2018

Location: Saitama Pref.

Module Output: 819.0kW

Completion year: January 2016

Location: Kagawa Pref.

Module Output: 1,490kW

Completion year: March 2019

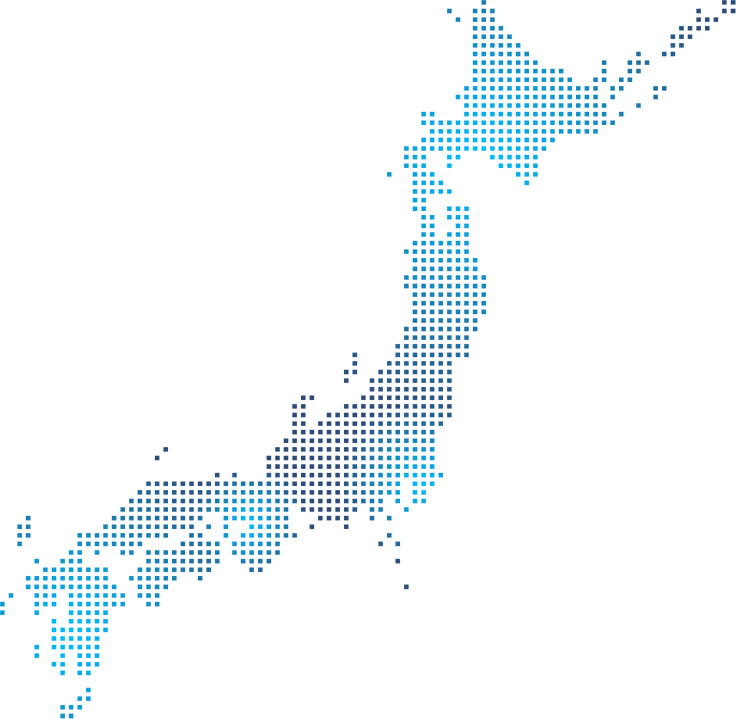

Hokkaido,

Tohoku Area

86.52MW

Kanto Area

56.29MW

Chubu,

Kansai Area

76.56MW

Chugoku, Shikoku,

Kyushu Area

80.75MW

Last Updated Date : Sep 30, 2024

Minato Management originates from the real estate industry. Needless to say, real estate and stocks are two of the main vehicles in the fund and investment markets. We take a wide variety of approaches in the real estate market to materialize investments and fund the formation of concepts at scales that best reflect the unique characteristics of our company.

Location: Fukushima Pref.

Size of Land: 132.3 square meters

Structure of Planned Building:

Ten-Storied Building Made of

Reinforced Concrete

Planned Use of Building: Apartment

| Location | Type of Real Estate |

Current Status |

|---|---|---|

| Fukuoka-City, Fukuoka | Entire Apartment Building | Owned |

| Fukuoka-City, Fukuoka | Condominium Ownership | Owned |

| Fukuoka-City, Fukuoka | Condominium Ownership | Owned |

| Fukuoka-City, Fukuoka | Condominium Ownership | Owned |

| Fujisawa-City, Kanagawa | Land With Leasehold Rights | Sold |

| Yokohama-City, Kanagawa | Entire Apartment Building | Sold |

| Itoshima-City, Fukuoka | Detached Land Building | Sold |

| Fukuoka-City, Fukuoka | Condominium Ownership | Sold |

| Fukuoka-City, Fukuoka | Entire Apartment Building | Sold |

| Yokohama-City, Kanagawa | Condominium Ownership | Sold |

Investment in large-scale tankers and passenger jets is a longstanding feature in Japan. In the past, however, both the size of these assets and the nature of the businesses were obstacles to their being commercialized as normal investment vehicles. However, by using our extensive experience and knowhow, we have successfully developed such assets into investment products and have incorporated them into investment funds.

Cargo Weight: 5,000 cbm

Charter Shipping Company:

European Company

Investment Structure:

Investment Through a “Tokumei Kumiai”,

limited Partnership

Other Track Record:

Chemical Tankers (newly built ships),

Car Carrier (newly built ships)

Japan’s market, which is not large by global standards, is home to us. As such, it is our mission to act as a bridge for investment, from abroad to Japan and from Japan to abroad. Minato Management has always paid close attention to cross-border trading ever since launching the fund management business. To meet the expectations of investors, we pursue international investment projects that only Minato Management can achieve.

Investment In Overseas Venture

Capital (VC) Funds

Target Assets: Limited Partnership

Investment in Overseas VC Funds

Investment Structure:

Investment Through a Partnership

Structure